The Silent Siege: How BDS is Reshaping Israel’s Economic Landscape

The Boycott, Divestment, and Sanctions (BDS) movement against Israel transcends symbolic gestures, delivering tangible, devastating blows to the Israeli economy.

The financial instability within Israel's market is becoming increasingly apparent. Recent data from the Tel-Aviv Stock Exchange (TASE) highlights significant withdrawals and financial shifts that underscore the economic impact of the BDS movement.

An Israeli banking executive recently exposed a grim reality: Israeli-owned entities and companies face unprecedented caution from international investors. This wariness, spurred by an informal boycott, has led to significant withdrawals from the Israeli market. In a dramatic exodus, over 34 billion shekels have been pulled from the Israeli stock market since the latest Gaza conflict began. This divestment includes 8 billion shekels from equities, 14 billion from government bonds, 6 billion from short-term loans, and 5 billion from corporate bonds. This silent economic siege powerfully demonstrates the shifting tides of global conscience.

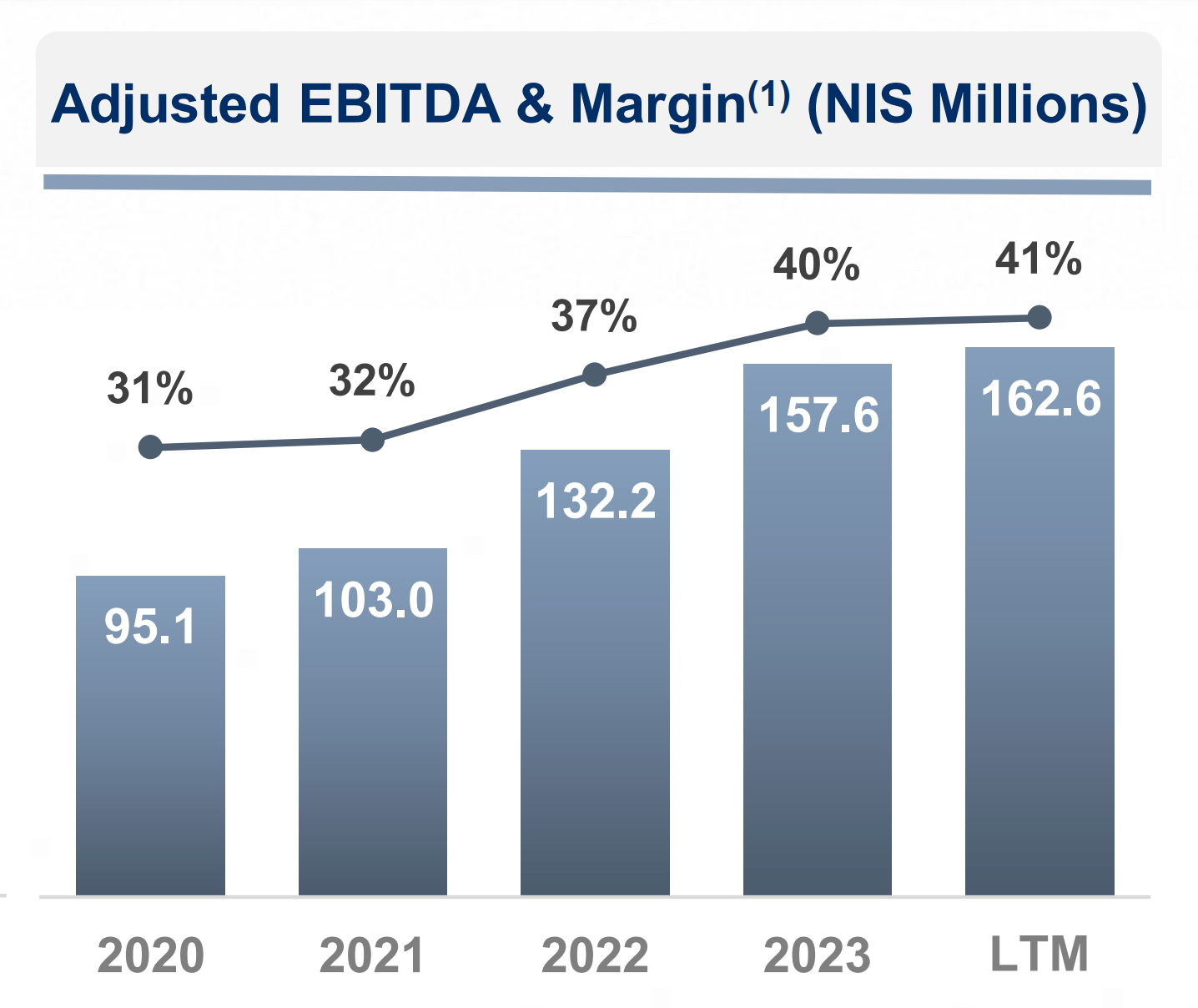

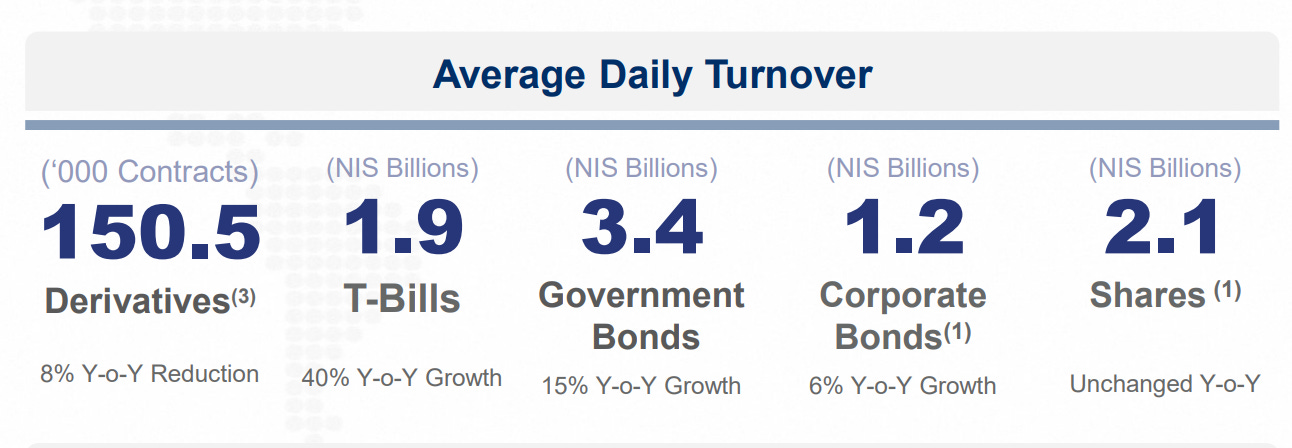

The TASE investor presentation for the quarter ended March 31, 2024, reveals critical details that further illustrate this instability. For instance, the market capitalization of T-Bills saw a significant 40% year-over-year growth, while government bonds experienced a substantial increase in market capitalization by 309% year-over-year. These dramatic fluctuations reflect the heightened financial activity and potential instability within the market.

Furthermore, the presentation indicates a notable reduction in derivative contracts by 8% year-over-year and a 2% year-over-year reduction in the number of share and bond companies listed on the exchange. These statistics underscore the declining confidence among investors in the Israeli market, likely influenced by the global BDS movement and ongoing regional conflicts.

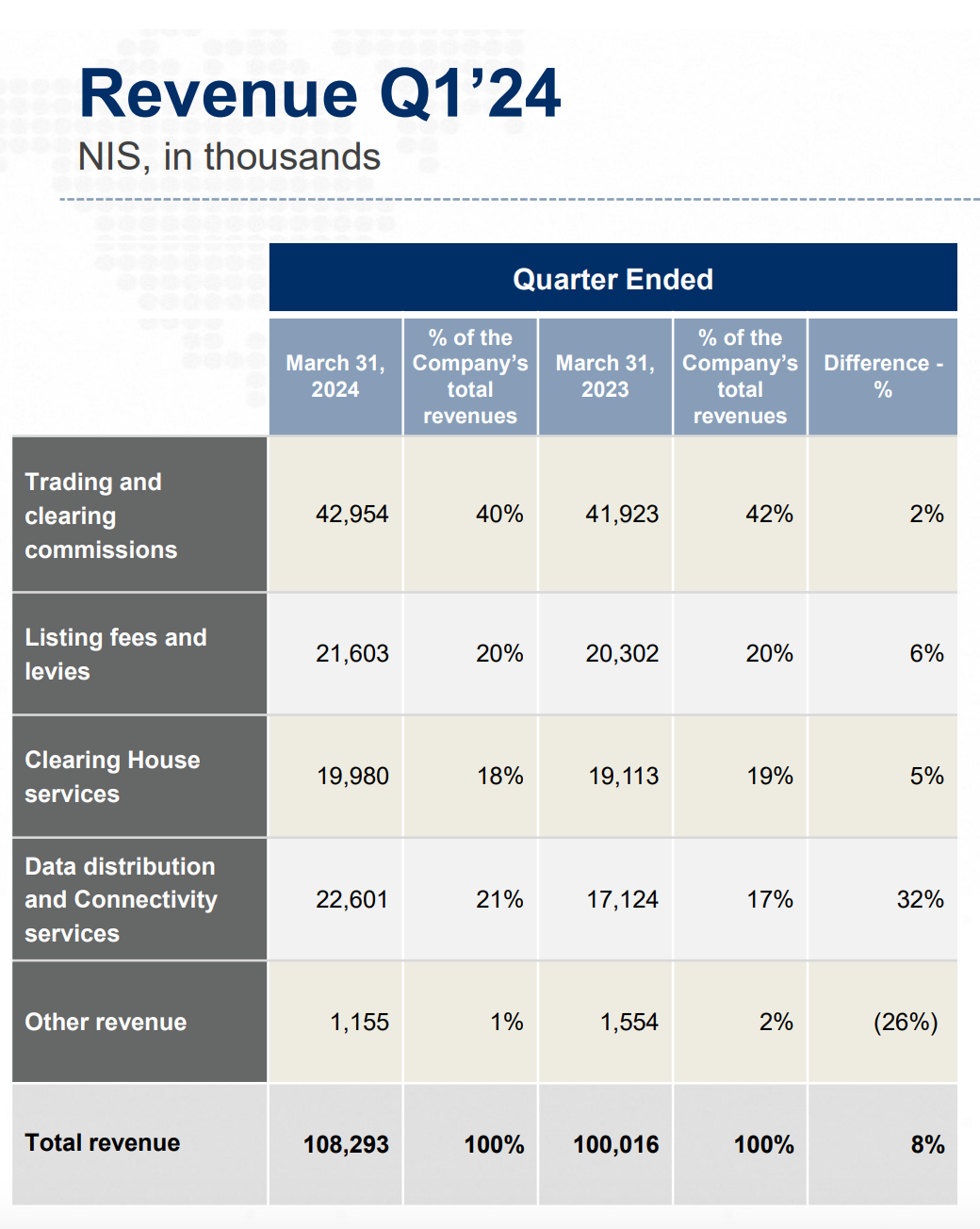

Additionally, changes in revenue from various market activities have been observed. Revenue from listing fees and levies increased by 6% year-over-year, reflecting financial adjustments and responses to the evolving market conditions.

However, the reduction in the number of trading days and effective commission rate changes contributed to a decrease in revenue from trading and clearing commissions. These operational disruptions or strategic shifts highlight the broader financial implications of the ongoing instability.

The chairman of the Israeli Security Authority emphasized that this trend predates the Gaza conflict but has intensified due to the ongoing violence. The war has accelerated the foreign investment exodus, pushing the Israeli economy into an increasingly precarious position. This rapid decline exposes deeper systemic vulnerabilities within Israel's economic framework, now laid bare by the relentless tide of global dissent.

The BDS movement emerged as a nonviolent response to Israel's oppressive treatment of Palestinians. It demands an end to a series of injustices: the construction of the West Bank wall, the relentless expansion of Jewish-only settlements, the annexation of East Jerusalem and the Golan Heights, and the systemic discrimination against Palestinian citizens within Israel. Despite the legitimacy of these grievances, U.S. lawmakers, influenced by the powerful pro-Israel lobby, have sought to stifle the movement. The Combatting BDS Act of 2019, though not enacted, epitomizes efforts to quash dissent and silence a growing call for justice.

Despite mounting governmental pressure, some corporations have stood in solidarity with the BDS movement. Ben & Jerry's, for example, faced significant backlash and legal threats for their principled stance against selling products in the occupied territories, leading their parent company, Unilever, to divest the brand. Similarly, Airbnb's initial support for the boycott was swiftly reversed due to relentless lawsuits. These incidents highlight the formidable influence of pro-Israel forces and the high stakes for companies daring to challenge the status quo.

Recently, Apple employees and shareholders issued a powerful open letter urging the company to cease matching employee donations to organizations linked to Israeli military actions in Gaza and illegal settlements in the West Bank. This letter demands an immediate investigation and the termination of such financial support, reflecting the burgeoning corporate pushback against Israel's policies. It signifies a critical moment in which corporate conscience is rising against complicity in state-sponsored oppression, echoing the broader calls for justice and accountability.

Initially, the Israeli government and media largely dismissed the BDS movement, focusing instead on the armed resistance of Palestinians. However, as BDS gained momentum, media outlets began to malign it as anti-Semitic, while Israeli advocates aggressively lobbied lawmakers to stymie its influence. This concerted effort birthed legislation like the Combatting BDS Act of 2019, which, though not enacted, sought to penalize those who dared to support the boycott. The escalating campaign against BDS reveals deep anxiety within Israel's power structures over the growing global repudiation of its policies.

The relationship between U.S. lawmakers and Israeli interests is remarkably robust, profoundly shaped by the political and financial clout of pro-Israel groups such as AIPAC. Representative Thomas Massie has shed light on this dynamic, revealing that every Republican representative is shadowed by an AIPAC-affiliated "babysitter" who steers their decisions regarding Israel. This symbiotic relationship frequently leads to U.S. policies that overwhelmingly favor Israeli interests, often at the expense of American ones. The pervasive influence of AIPAC underscores the erosion of genuine democratic decision-making in favor of serving a foreign power's agenda.

The resistance to the BDS movement and the ongoing conflict in Gaza highlight a more profound issue: the systematic suppression of nonviolent protests, which often precipitates more extreme outcomes. The events of October 7 are seen by some as the inevitable consequence of ignoring the peaceful demands championed by the BDS movement. This cycle of repression and violence reveals a troubling disregard for nonviolent avenues of dissent, ultimately fostering an environment where desperation breeds more drastic actions.

Furthermore, the mounting financial strain on Israel could soon lead to calls for U.S. financial assistance, a troubling prospect given America's own economic challenges. The potential redirection of U.S. taxpayer money to bail out the Israeli economy is a contentious issue poised to ignite significant public debate. This scenario exposes the inherent tension between domestic priorities and the obligations imposed by an entrenched alliance, raising critical questions about the true beneficiaries of U.S. foreign policy.

The economic impact of the Israel boycott is profound and escalating, despite a pervasive media blackout. The BDS movement, grounded in the pursuit of justice and equality, persistently faces fierce resistance from entrenched political and corporate powers. The intricate web of connections between U.S. lawmakers and Israeli interests further muddies the waters, casting a stark light on the corrosive influence of foreign lobbying on American policies. As the situation unfolds, the imperative for transparent and equitable reporting on these critical issues becomes ever more urgent.

Hooray! Let's keep up the good work!

Here's a comprehensive list that can be used for this purpose: https://www.cjpme.org/boycott

Oussama, your reporting on the growing effects of the heroic BDS movement is appreciated. Much more light needs to be shined on the numerous cogent points that you have elucidated regarding the sinister and corrupt connections between nazisraeli interests and the amerikkkan political and economic system. Unfortunately, we cannot rely upon principled and comprehensive honest reporting from the corporate-mouthpiece "media", which has long ago abandoned its responsibility to inform the public.